Tax Training in Lahore starting 15 January 2022, P

EducationTickets Closed. To check more events click here

Description

Tax Training in Lahore starting 15 January 2022, P

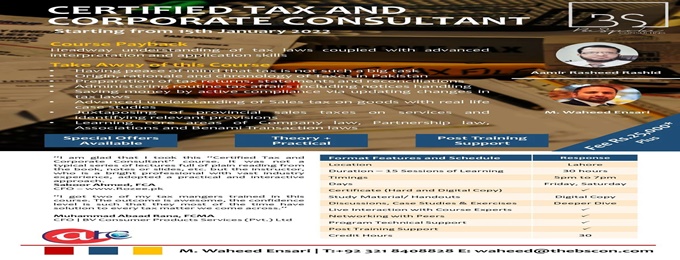

Certified Tax and Corporate Consultant

30 Hours Training | Twice a Week | Fridays & Saturdays | Fee PKR25,000

Call 0321 8408828

About this Event

Certified Tax and Corporate Consultant

30 Hours Training | Twice a Week | Fridays & Saturdays | Fee PKR25,000

Call for more information 03218408828 or email

What Will You Learn

Understanding of Taxes in Pakistan

Calculation of tax liability for withholding taxes

Preparation of income tax returns, WHT statements

Handling day to day tax matters, notices handling

Avoiding penalties and surcharge

Registratin link:

Who Should Attend

Entrepreneurs, Tax Managers, Auditors, Accountants, Compliance Managers, Fresh Graduates, Tax Advisors, Compliance Officers, Tax Consultants, Business Owners, Tax Consultants, Tax/Accounting/Audit/Compliance and Finance Professionals

Course Brief Topics

Income tax: Introduction to income tax law and practices

Income tax return & withholding tax statements, Handling departmental notices and Techniques to handle departmental audit, Tax Assessments, appeals and procedure and penalties & prosecution

Federal and Provincial Sales Tax: Basic concept & mechanism in Pakistan and filing of monthly returns

Corporate Laws & Other: Registration of a company (manual & e-filling), Partnership, chamber of Commerce

Course Outline

Income tax: Introduction to income tax law and practices

Overview of Tax Compliance under Income Tax Laws

Requirements of E-filing and consequences for non-compliance

E-Enrollment of Taxpayers on Portal

Tax Payments Challans on E-Portal

How to apply refund with FBR

Computation of taxable income under the head

Preparation & submission of income tax return (Individuals, AOPs and Companies)

Preparation & submission of withholding tax statements

Withholding tax, WHT agents and statements filing

Rights & duties of withholding agent Withholding Tax in the eyes of superior courts

Advance tax u/s 147

Handling departmental notices

Techniques to handle departmental audit (withholding & other)

Tax Assessments, appeals and procedure

Default surcharge penalties & prosecution

Call for more information 03218408828 or email

Registratin link:

Federal and Provincial Sales Tax

Basic concept & mechanism in Pakistan

Registration and filing of monthly returns

Constitutional validity

Understanding of important terms

Retail price item

Scope of Extra & further Tax

Zero rations

Time, Manner and Mode of Payment

Difference between Federal and Provincial Sales tax

Understanding the law

Specimens of sales tax invoices /Purchase/ register/ debit/ credit notes and other record

Preparation by using MS Excel Preparation of return

E filling procedure Determination of sales tax liability

Corporate Laws & Other

Choosing the right entity

Registration of a company (manual & e filling)

Maintenance of records

Preparation & submission of document

Handling with other day to day matters

Preparation of Partnership deed

Registration & de-registration of a partnership

Registration with chamber of Commerce

Learning objectives

To give confidence in handling day to day matters involved in Taxation like; manual and electronic preparation and submission of returns/statements, calculation of taxable figure in complicated cases, handling with notices, audit, assessment, and appeals.

The delegates will feel confident while handling routine tax matters like preparation, tax planning and electronic submission of returns and statements

The participants will be able to handle day to day tax matters of their own business, employer, clients etc. in a professional way

Different rates of taxes and discussion circulars, clarifications, explanations issued by FBR

Broaden knowledge through elective modules in Regional Tax, Tax Incentives, Tax Fraud and Investigation

Suited for candidates seeking a specialist career in tax advisory

To provide in-depth knowledge of updated Income Tax & Sales Tax Laws

To provide requisite knowledge of the Companies Act, 2017 for handling day to day matters of a company

To enlighten all major aspects of respective tax statutes and develop skills for making strategic tax planning

To deliver comprehensive knowledge of the statutes through hands-on training, practical examples and case studies

To develop reasonable practical skills for maintenance of records in accordance with the provisions of Income Tax, Sales Tax, Provincial Sales Tax and Corporate Laws

The course will be interactive and includes a combination of theory and practical exercises.

The information will be presented using these training methods:

Presentation

Case Studies

Real Time Examples

Scenarios

Exercises

Discussions

Training facts

Handouts and all the relevant material will be given during the training

Hands-on training, practical examples and case studies

A certificate of attendance for participants

All the modules will contain 100% practical exercises and hands on support to the participants. They will perform all the tasks in the Training and will be given assignments, case studies discussed. The course will be interactive and includes a combination of theory and practical exercises.

We will also provide post course assessment via Professional Tax Quiz as learning is an on-going process. Suited for candidates seeking a specialist career in tax advisory.

Training Fee : PKR25,000

Terms of Payment : Two (2) weeks prior to the training

Course Duration : 30 Hours | Twice a Week | Fridays & Saturdays

Class Timing : 5pm to 7pm

Call for more information 03218408828 or email [email protected]

Also check out other Workshops in Lahore, Business Events in Lahore.

Tickets

Tickets for Tax Training in Lahore starting 15 January 2022, Practical Tax Training can be booked here

Questions or Comments